Partner Liquidity Network

New Warehouse & “Takeout” Options for Home Equity

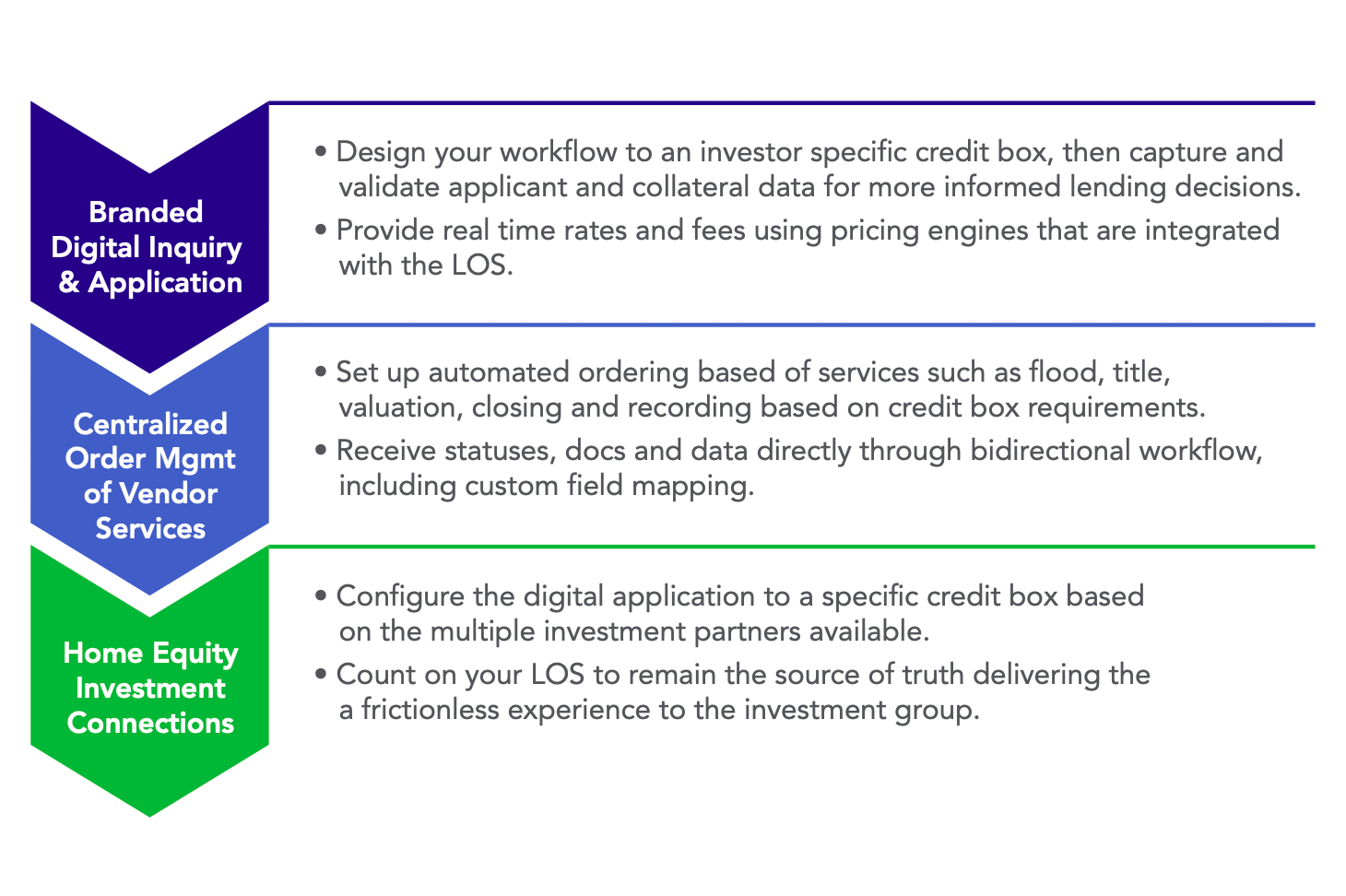

At FirstClose, our mission has always been to help lenders efficiently capture home equity opportunities. Our advanced technology enables banks and credit unions to offer their customers and members a digital home equity experience, marked by unparalleled speed and convenience. Now, through our collaboration with innovative secondary market leaders, we are

adding new options that will enhance efficiency and liquidity in the home equity financing process.

Home equity lending continues to be a significant opportunity to grow volume and nurture relationships, but to effectively take advantage of this opportunity lenders need both modern origination technology, designed for home equity lending, and liquidity. Our award-winning technology coupled with our strategic alliances with some of the industry’s finest, allow us to

deliver an expanded solution set to not just get started in the home equity space, but to compete and excel in it.

FirstClose recognizes the need for lenders to offer more options beyond 1st Mortgage programs in the current rate environment and partnering with multiple investment offerings can help align your desired program with the correct investor.

Liquidity Network

Our Liquidity Network helps connect lenders to leading capital markets liquidity providers. This offering provides new liquidity options for independent mortgage bankers, fintechs, and any lenders looking to enter or expand in the home equity lending space as well as a secondary market for portfolio lenders looking to balance their exposure to this asset class.

How it Works

As the FirstClose lender, you will work directly with our investment group and sign a home equity specific Mortgage Loan Purchase Agreement (MLPA). Under the agreement, you will gain access to the rate schedule and underwriting guidelines to enable the best revenue generation opportunities for your organization.

Our investor network will provide warehouse lines to joint non-bank clients moving into the home equity space as well as providing a takeout for home equity assets for both depository and non-bank lenders.

The network understands and values the fact that FirstClose technology will originate quality digital assets. This will speed up the bidding and closing processes for your home equity assets (both HELOCs and CESs), reducing time on warehouse lines and enabling you to replenish capital faster and benefit from healthy gains on sale.