Our takeaways from ICE Experience ‘24

By: Carol Crawford

Chief Marketing Officer, FirstClose

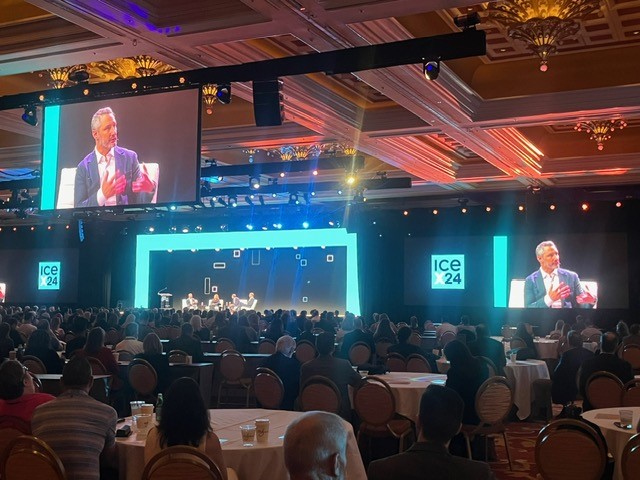

Last month, our team shipped out to Las Vegas for the annual ICE Experience as a proud sponsor. Each year, the ICE Experience brings together more than 2,000 mortgage industry professionals for three full days of specialized tracks, breakout sessions, training, networking and keynotes. This year’s theme, “Make the Connection” encouraged attendees to reconnect with industry colleagues and learn about the latest technologies defining the mortgage industry while offering training, solutions and networking to improve compliance, loan quality and efficiency.

Let’s unpack some key takeaways that were the highlight of this year’s show.

1. Home Equity is Still Hot 🔥

Home equity has been a hot topic in our industry for quite some time now, and it doesn’t seem to be cooling down anytime soon. As we attended the ICE Experience conference, one of our biggest takeaways was the continued focus on home equity and its impact on both lenders and homeowners.

U.S. home values have increased by more than 32% year over year, providing a huge opportunity for lenders and investors. According to CoreLogic, to date, there is $28 trillion of tappable equity and $3.8 trillion in collective home equity gains since Q4 of 2021. In almost all of our meetings with lenders one things was clear, everyone’s looking to either up their home equity game this year or get into the space. That’s where we come in.

Our FirstClose Equity solution is fully integrated into Encompass. Through the integration, Encompass users can seamlessly originate HELOCs and home equity loans directly within the LOS and complete the application through closing process in as little as five days versus the industry average of 45 to 60 days.

With record levels of tappable equity and its potential impact on both individual homeowners and the broader economy, it’s clear that home equity is still very much a hot topic in today’s market.

2. Lenders Love Puppies 🐶

One of the most adorable and heartwarming moments at this year’s ICE Experience was the appearance of several furry, four-legged friends. The puppies at this year’s Dog Park were brought in by the Nevada SPCA and they wound up stealing the show with their playful energy and lovable nature. Attendees were able to stop by, take a break from the show, play with a puppy, and even inquire about adoptable dogs. We’re happy to report that every dog that was at show was adopted and through combined efforts we raised nearly $10,000 for the Nevada SPCA and the wonderful local rescue that participated in the event, Wagging Tails Rescue .

3. The Power of Embracing Automation

Another key theme at this year’s show was about leveraging automation to streamline the origination process, cut costs and improve the overall borrower experience.

At the show, we announced that our home equity settlement services ordering module within Firstclose Equity is now available in Encompass. The FirstClose Equity order management module is a loan-centric platform that streamlines the ordering and management of settlement services including flood certification, property condition reports, title insurance, automated valuation models (AVMs), desktop valuations and hybrid and full appraisals.

Like ICE, we share a commitment to driving efficiency in the industry and making the path to homeownership as streamlined and accessible as possible. With this integration, an Encompass user can be up and running on our platform within a matter of weeks and can automate the ordering of needed home equity settlement services.

Didn’t have a chance to make the connection at the show?

Let’s schedule a time to meet with our team and talk about your home equity needs.